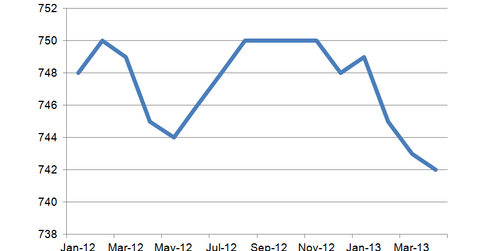

While they all calculate FICO credit scores, their data might be slightly different, which can lead to variations in scores.Īlso, FICO updates its scoring methodology over time, resulting in many potential scoring models for lenders to consider. Most people have information at each of the three major credit bureaus – TransUnion, Equifax, and Experian. And the FICO score you pull through your credit card company probably isn’t the same one your mortgage lender will consider. One confusing aspect of credit scores for consumers is that we each have multiple scores. So, what score do you need to consider before applying for a mortgage? Understanding Which Credit Score Matters Most In 20-years, someone with a 680-699 score will still pay over $20,000 more in interest on a $244,000 mortgage than a person with a high score. That’s a difference that may sound minuscule, but isn’t. Assuming nothing in a mortgage application changes except the credit score, someone with a score in the 680-699 range would have a mortgage rate approximately 0.399 percentage points higher than a person with a 760-850 score. The difference between a good and great score can still add up over the life of a loan. Yet, it isn’t just low credit score borrowers that pay the price. But a credit score gives the bank an idea about whether you’re likely to make payments responsibly even if things change. Your current financial picture – including down payment, assets, and income – are important.

Over that time frame, you’ll likely change jobs, face tough times, watch your neighborhood change, and go through multiple market cycles. Think about it from the bank’s perspective. When it comes to determining your mortgage rate, your credit score is a critical factor.

Why Credit Scores Matter for Mortgage Rates

0 kommentar(er)

0 kommentar(er)